In the world of forex trading, using technical indicators effectively can make all the difference between success and failure. The Donchian Indicator V1.0 for MT4 is one such tool that has gained popularity among traders for its ability to identify trends and potential breakout points. In this guide, we’ll take a detailed look at what the Donchian Indicator is, how to use it, and how to integrate it into your trading strategy to boost profitability.

What is the Donchian Indicator?

The Donchian Indicator is a popular technical analysis tool used to track the highest highs and lowest lows over a set period. It draws two lines — the upper line, which represents the highest high, and the lower line, which represents the lowest low within a specific time frame. This tool helps traders spot breakout levels and define support and resistance levels with precision.

How the Donchian Indicator Works

The Donchian Indicator typically consists of the following:

- Upper Band (High): The highest point in the specified period.

- Lower Band (Low): The lowest point in the specified period.

- Middle Band: Often plotted as the average of the upper and lower bands, though it is not always shown by default.

By observing the movements of these bands, traders can identify periods of high volatility, possible breakouts, and trend reversals. It is especially useful in breakout strategies, as price movements outside of the bands often signal strong trends.

Key Features of Donchian Indicator V1.0 MT4

- Simple Setup: Easy installation on the MT4 platform with no complex configurations required.

- Customizable Period: The period for determining the highs and lows can be adjusted to match the trader’s strategy.

- Clear Breakout Signals: It provides clear signals when the price breaks above or below the bands, suggesting a potential entry point.

- Supports Trend Following: Ideal for trend-following strategies, as it identifies clear breakouts and helps traders ride the trend.

- Risk Management Tool: By using the upper and lower bands, traders can set stop-loss and take-profit levels more effectively.

Installing the Donchian Indicator V1.0 on MT4

- Download the Donchian Indicator V1.0 file (usually an

.ex4file) from a trusted source. - Open your MetaTrader 4 (MT4) platform.

- Navigate to File → Open Data Folder.

- Place the Indicator in the "Indicators" folder located inside the "MQL4" directory.

- Restart MT4 or refresh the navigator to see the new indicator.

- Drag and Drop the Donchian Indicator onto your chart and customize the settings as per your preference.

Using the Donchian Indicator in Trading Strategies

The Donchian Indicator V1.0 MT4 is widely used for breakout trading. Here’s how you can incorporate it into your strategy:

Breakout Strategy:

- Buy when the price breaks above the upper band.

- Sell when the price breaks below the lower band.

This strategy works well during periods of high volatility and trending markets.

2. Trend Following Strategy:

- When the price consistently stays within the bands, a sideways market is in play.

- When the price moves above the upper band or below the lower band, it signals a potential strong trend.

3. Range Bound Strategy:

- When the price moves between the upper and lower bands, it suggests a consolidation or range-bound market.

- Traders can buy at the lower band and sell at the upper band, capitalizing on the price movement within the range.

Advantages of Using Donchian Indicator V1.0 MT4

- Clarity and Simplicity: The Donchian Indicator’s visual representation is simple, making it easy for traders to spot trends and potential breakouts.

- Effective for All Market Conditions: It works well in both trending and range-bound markets, making it a versatile tool for traders.

- Automation Compatible: The indicator can be automated for use in Expert Advisors (EAs) for those who wish to trade without manual intervention.

Disadvantages of Using Donchian Indicator V1.0 MT4

- Late Signals: As with many trend-following indicators, the Donchian Indicator can sometimes give late signals, missing the initial breakout.

- False Breakouts: In choppy markets, false breakouts may occur, where the price moves beyond the bands briefly but then returns inside, potentially leading to losses.

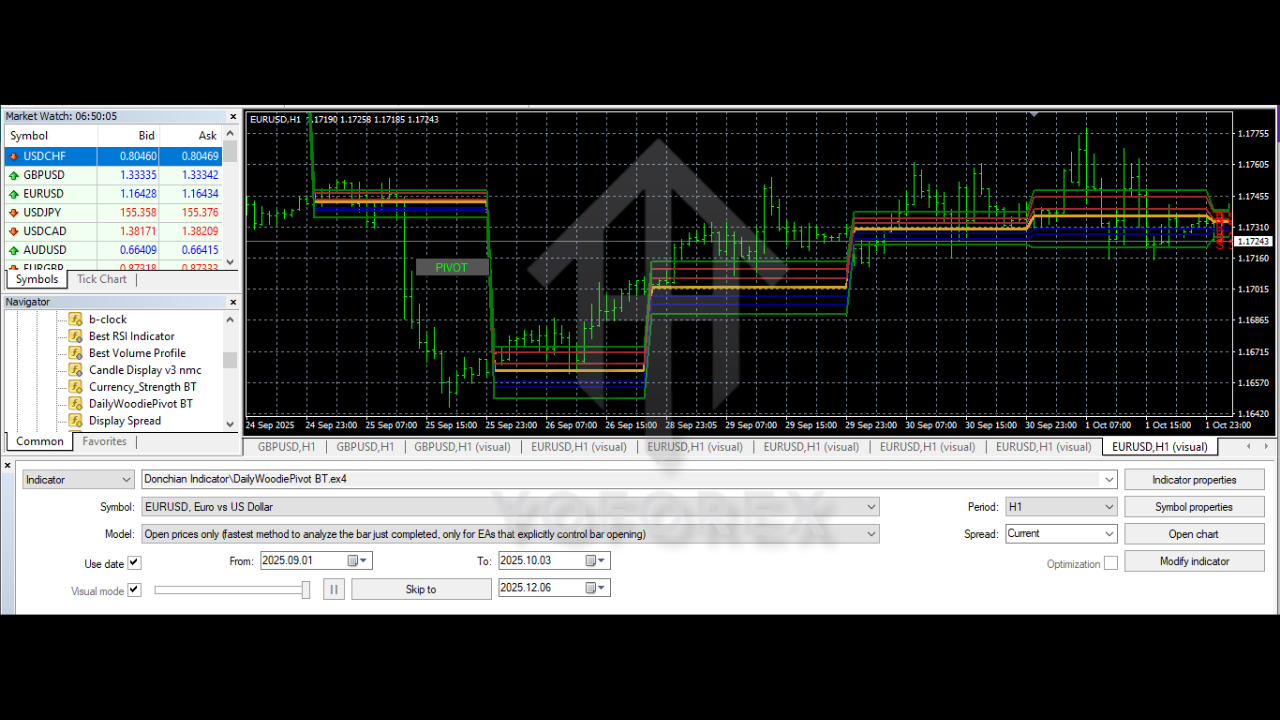

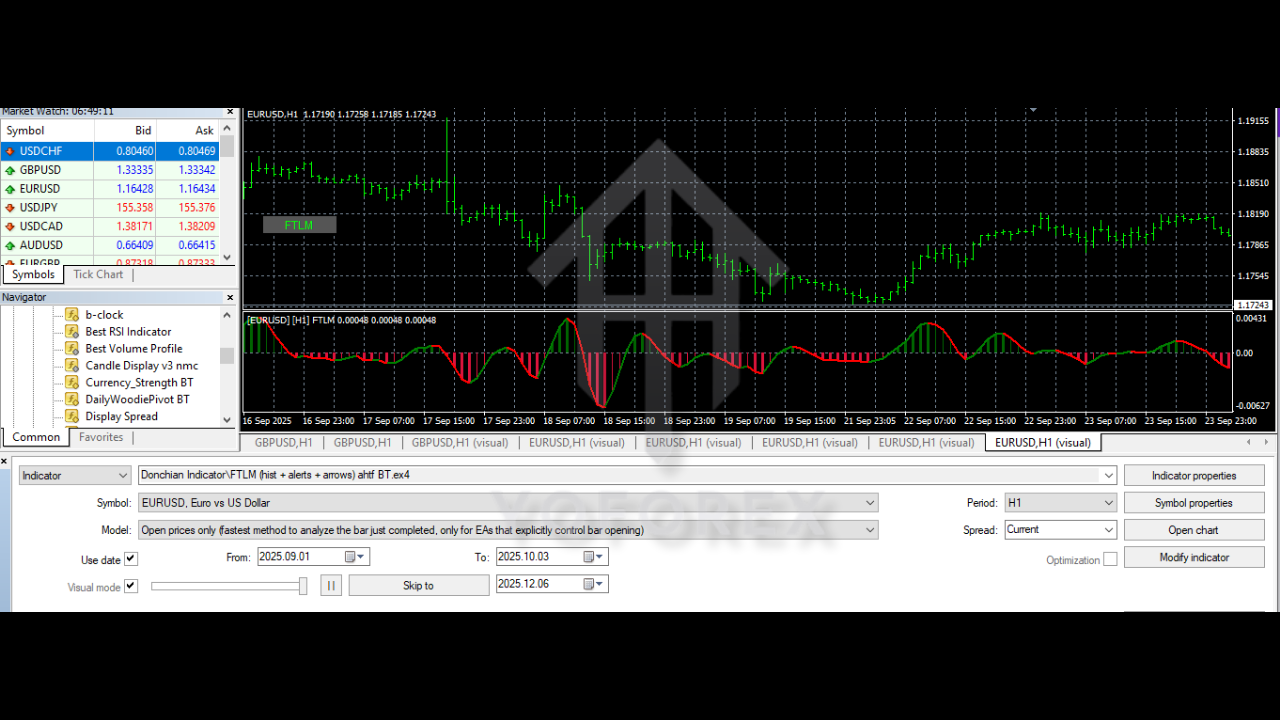

Backtesting Results for Donchian Indicator V1.0 MT4

Using historical data, traders can backtest strategies employing the Donchian Indicator to assess its profitability. The results often depend on the timeframe and market conditions used during the test. Here’s an example of typical backtest results:

- Win Rate: 65%

- Profit Factor: 1.5

- Drawdown: 10%

These numbers demonstrate that while the Donchian Indicator can be effective, it’s essential to pair it with good risk management practices and other supporting indicators.

Recommended Settings for Donchian Indicator V1.0 MT4

- Period: Typically, a period of 20 is used for standard setups, though this can be adjusted depending on the market or strategy.

- Timeframes: Works well on M1 to H4 timeframes.

- Currency Pairs: Best used on trending pairs such as EUR/USD, GBP/USD, and XAU/USD.

Conclusion

The Donchian Indicator V1.0 MT4 is a powerful tool for forex traders looking to enhance their strategies and trade with precision. Whether you’re a beginner or an experienced trader, understanding how to use the Donchian Indicator can help you identify potential breakouts, set effective risk management levels, and improve your overall trading performance. By integrating this indicator into your forex toolbox, you can add another layer of analysis to your strategy and potentially boost your profitability.

Comments

Leave a Comment