Gold trading has always occupied a special place in the forex market. XAUUSD is known for its high volatility, deep liquidity, and explosive price movements during both technical breakouts and macroeconomic events. While these characteristics make gold attractive, they also make manual trading extremely demanding. Precision timing, disciplined risk control, and emotional neutrality are difficult to maintain consistently when trading gold manually.

This is where automated trading systems come into play. Gold Overlord EA V1.0 MT4 is an Expert Advisor designed specifically for gold traders who want structured, rule-based execution without emotional interference. Built exclusively for MetaTrader 4, this EA focuses on XAUUSD and aims to exploit directional market movements while maintaining internal controls to manage exposure during unfavorable price action.

In this in-depth review, we will explore how Gold Overlord EA V1.0 MT4 works, its trading philosophy, risk management approach, recommended usage, and who this EA is best suited for.

What Is Gold Overlord EA V1.0 MT4

Gold Overlord EA V1.0 MT4 is a fully automated trading robot created for the MetaTrader 4 platform. It is designed to trade gold pairs, particularly XAUUSD, using a combination of trend detection, entry optimization, and dynamic position handling.

Unlike generic multi-pair EAs that attempt to trade dozens of instruments with the same logic, Gold Overlord EA focuses solely on gold. This single-instrument specialization allows the strategy to align more closely with the behavior, volatility structure, and liquidity characteristics of the gold market.

The EA operates autonomously, scanning market conditions, identifying potential trading opportunities, placing trades, managing open positions, and exiting trades based on predefined logic.

Core Trading Logic and Strategy Design

At its core, Gold Overlord EA V1.0 MT4 is designed around directional market behavior. Gold is known to trend strongly during certain sessions and macroeconomic phases, and this EA attempts to position itself in alignment with those movements rather than scalping random fluctuations.

The system begins by analyzing market direction using internal trend filters. These filters evaluate momentum, price structure, and volatility conditions before allowing any trade execution. Trades are only initiated when the system identifies conditions that favor continuation rather than choppy or uncertain price action.

Once an entry is triggered, the EA manages the position dynamically. Instead of relying on static take-profit and stop-loss logic alone, the EA adapts its trade handling based on ongoing price behavior. This allows it to react to both trending extensions and temporary retracements in a structured manner.

The overall objective is not high-frequency trading but controlled exposure during favorable market conditions.

Position Management and Risk Handling

Risk management is a critical aspect of any gold trading system, and Gold Overlord EA V1.0 MT4 incorporates internal mechanisms aimed at controlling exposure.

The EA does not blindly stack trades without logic. Position scaling, when used, follows predefined constraints and only occurs under specific market conditions. This approach is intended to optimize entry pricing while maintaining oversight over total exposure.

Additionally, the EA includes protective logic designed to reduce risk during abnormal volatility spikes. Gold is particularly sensitive to economic releases, geopolitical events, and sudden liquidity shifts. The EA’s internal filters aim to avoid entering trades during periods that historically carry higher execution risk.

Users are still encouraged to configure lot sizes responsibly and align the EA’s settings with their account size and risk tolerance.

Recommended Trading Conditions

For optimal performance, Gold Overlord EA V1.0 MT4 should be used under appropriate trading conditions.

A low-spread broker environment is strongly recommended, as gold spreads can widen significantly during volatile periods. Stable execution and minimal slippage help ensure that the EA’s logic functions as intended.

The EA performs best on accounts that can tolerate short-term drawdowns without emotional interference. While it is designed to manage risk internally, gold trading by nature involves periods of volatility that require patience and discipline.

Using a VPS is also recommended to maintain uninterrupted execution, especially during active market sessions.

Account Size and Lot Configuration

Gold Overlord EA V1.0 MT4 can be configured to operate on various account sizes, but conservative risk settings are advised, particularly for smaller accounts.

Users should avoid aggressive lot sizing in an attempt to accelerate profits. Gold market volatility can amplify both gains and losses quickly, making disciplined configuration essential.

The EA allows flexibility in adjusting risk parameters, enabling traders to tailor performance expectations based on their capital and trading objectives.

Advantages of Gold Overlord EA V1.0 MT4

One of the key strengths of Gold Overlord EA V1.0 MT4 is its specialization. By focusing exclusively on XAUUSD, the EA avoids the pitfalls of generic multi-pair systems that fail to adapt to instrument-specific behavior.

Another advantage is its structured trade management approach. Trades are not left unattended; instead, they are monitored and adjusted based on evolving market conditions.

The EA also removes emotional decision-making from gold trading. Fear, greed, hesitation, and overtrading are common issues among manual traders, especially during volatile gold sessions. Automation ensures consistent execution according to predefined rules.

Limitations and Risk Awareness

While Gold Overlord EA V1.0 MT4 offers a structured approach to automated gold trading, it is not a guaranteed profit system. No EA can eliminate market risk entirely.

Periods of strong one-directional movement against the EA’s position can lead to drawdowns. Users must understand that gold trading inherently carries risk, and automated systems are tools, not magic solutions.

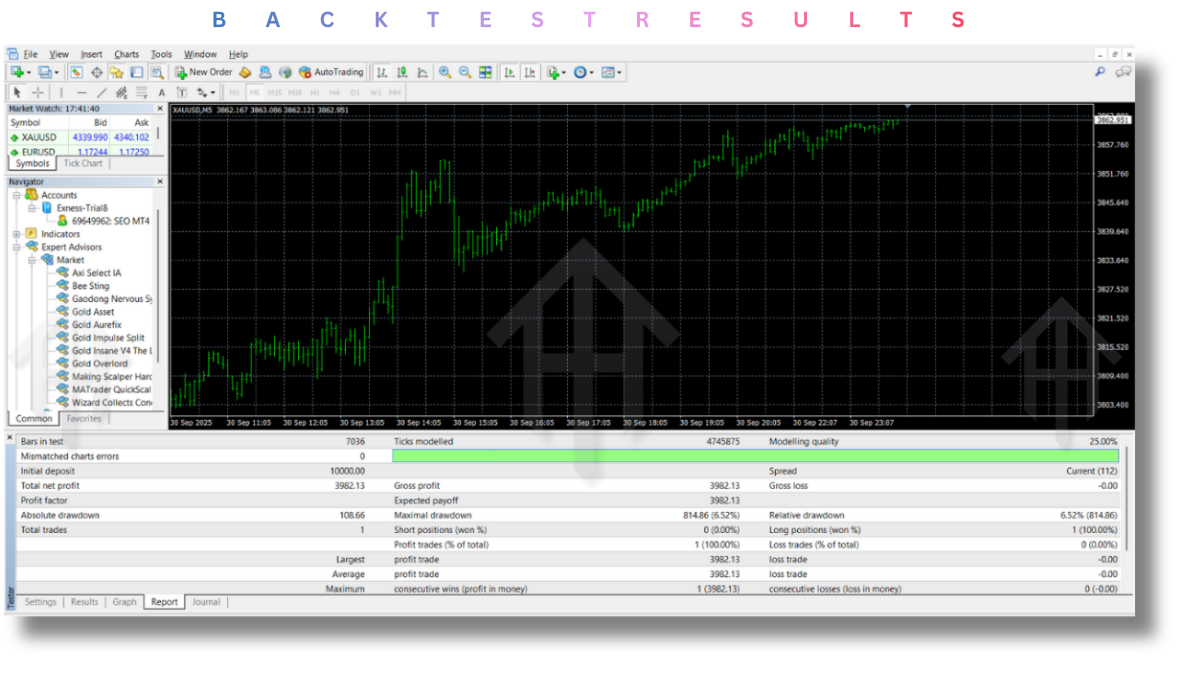

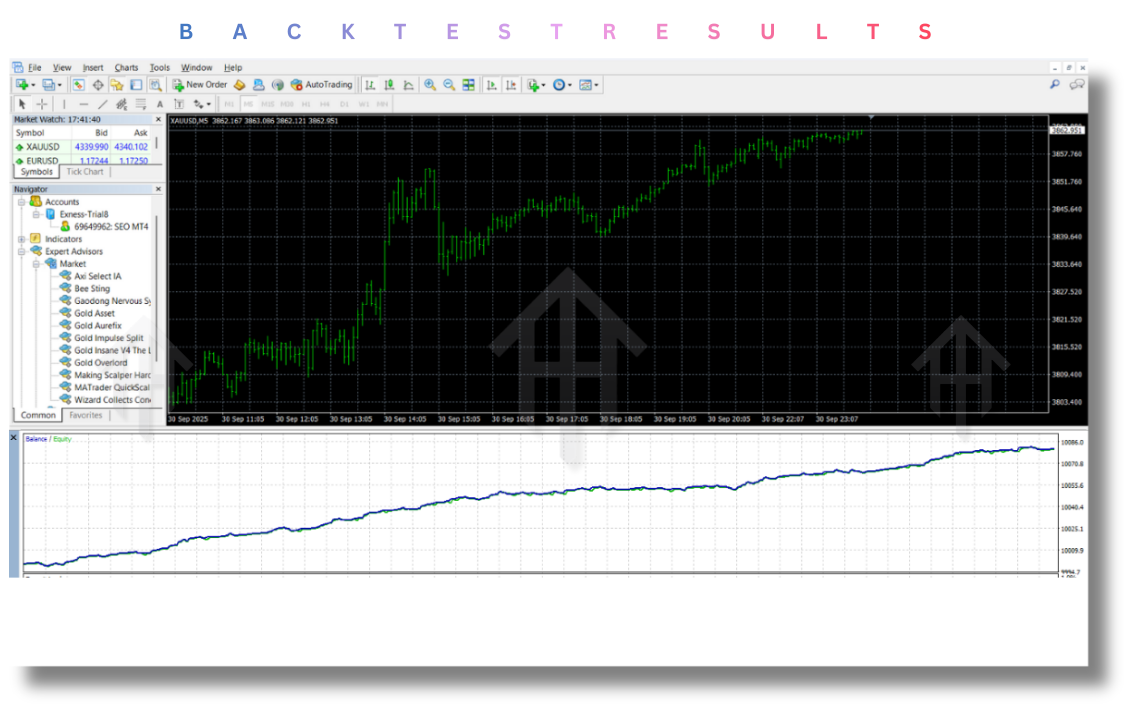

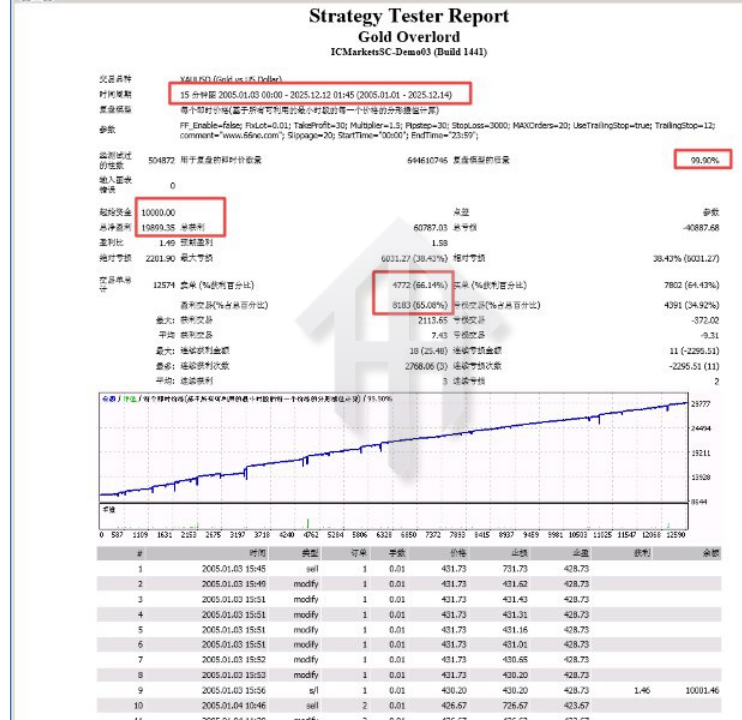

Proper testing, demo usage, and risk calibration are essential before deploying the EA on a live account.

Who Should Use Gold Overlord EA V1.0 MT4

This EA is best suited for traders who want exposure to gold without actively managing trades throughout the day. It is ideal for individuals who prefer rule-based execution and disciplined strategy logic.

Beginner traders can benefit from the automation aspect, provided they understand the basics of risk management and account sizing. Intermediate and advanced traders may appreciate the EA as part of a diversified trading approach.

However, traders looking for ultra-high-frequency scalping or guaranteed daily profits may find this EA unsuitable.

Final Verdict

Gold Overlord EA V1.0 MT4 is a specialized automated trading system designed for XAUUSD traders seeking structured, disciplined execution. Its focus on trend-based logic, controlled position handling, and adaptive trade management makes it a compelling option for traders who understand the realities of gold market volatility.

When used responsibly, with proper configuration and realistic expectations, Gold Overlord EA V1.0 MT4 can serve as a valuable tool in an automated trading setup.

Upgrade

Upgrade your gold trading approach by integrating automation that prioritizes structure, discipline, and consistency. Gold Overlord EA V1.0 MT4 is designed for traders who value calculated execution over emotional decision-making.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment