Automated trading is revolutionizing the way traders approach the forex market. With the advent of Expert Advisors (EAs), traders can now rely on algorithmic systems to execute trades without constant monitoring. One such EA gaining attention is the Golden Dome EA V1.25 for MT4. This EA claims to offer a robust trading solution by combining time-tested technical indicators with an advanced trading strategy. In this review, we will take a closer look at Golden Dome EA, exploring its features, performance, and suitability for forex traders.

What is Golden Dome EA V1.25 MT4?

Golden Dome EA V1.25 is a MetaTrader 4 (MT4) Expert Advisor designed to automate trading in the forex market. This EA relies on a blend of popular technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Bollinger Bands, and Exponential Moving Averages (EMA) to generate trading signals. The strategy is based on price action and technical analysis, allowing it to be used across a wide range of assets.

Key Features of Golden Dome EA V1.25 MT4

Golden Dome EA offers several features that aim to simplify the trading process and help traders make informed decisions:

- Multi-indicator Strategy: The EA utilizes a combination of four major indicators: RSI, MACD, Bollinger Bands, and EMAs. This multi-layered approach allows for more accurate signals and reduces the likelihood of false entries.

- Adaptive Trading System: Golden Dome EA is designed to be adaptable to various market conditions. It adjusts its strategy depending on market volatility, aiming for better risk-adjusted returns.

- Grid Trading Feature: For more aggressive traders, the EA offers a grid trading option. This feature allows the system to open multiple trades in different directions to take advantage of market movements.

- Stop Loss & Take Profit Mechanism: The EA comes with built-in risk management features, including stop loss and take profit settings. These features help protect your capital and lock in profits at predefined levels.

- News Filter: To avoid market disruptions caused by economic news events, Golden Dome EA comes with an optional news filter. This feature automatically pauses trading around significant news releases to prevent volatility from affecting your trades.

- Works on Various Assets: Although it is optimized for XAUUSD (gold), the EA can be used across different forex pairs, commodities, indices, and even cryptocurrencies, making it a versatile choice for traders who want to diversify their portfolios.

How Golden Dome EA Works

Golden Dome EA executes trades based on the signals generated by the combination of the four indicators. The strategy involves the following steps:

- Trend Identification: The EA first determines the market trend using the MACD and EMA indicators.

- Signal Confirmation: Once the trend is established, the RSI and Bollinger Bands are used to confirm potential entry points.

- Trade Execution: Upon confirmation, the EA opens a trade, applying stop loss and take profit levels based on the trader’s settings.

- Risk Management: The grid mode can be activated to open additional trades if the market moves against the initial position. This feature allows the EA to capitalize on market fluctuations and recover losses.

- News Filter: During significant news events, the news filter pauses all trades to prevent trading during highly volatile periods.

Recommended Settings for Golden Dome EA

To maximize the potential of Golden Dome EA, it’s essential to use the right settings. Here are some recommended configurations:

- Timeframes: Golden Dome EA performs best on the H1 (1-hour) and H4 (4-hour) timeframes. These timeframes provide a balanced view of market trends and are ideal for the EA's strategy.

- Lot Size: Depending on your account size, use a conservative lot size. For smaller accounts, start with a 0.01 lot size and gradually increase as your account grows.

- Risk Settings: While the EA comes with a built-in risk management system, it's advisable to fine-tune your risk percentage to match your risk tolerance. A risk percentage between 2% and 5% is ideal for most traders.

- Grid Trading: If you're an experienced trader and understand the risks associated with grid trading, you can enable this feature. However, for more conservative traders, it is best to keep it disabled.

- Stop Loss and Take Profit: Set stop loss and take profit levels according to your trading strategy. A good rule of thumb is to aim for a 1:2 risk-to-reward ratio, where your potential profit is at least twice your risk.

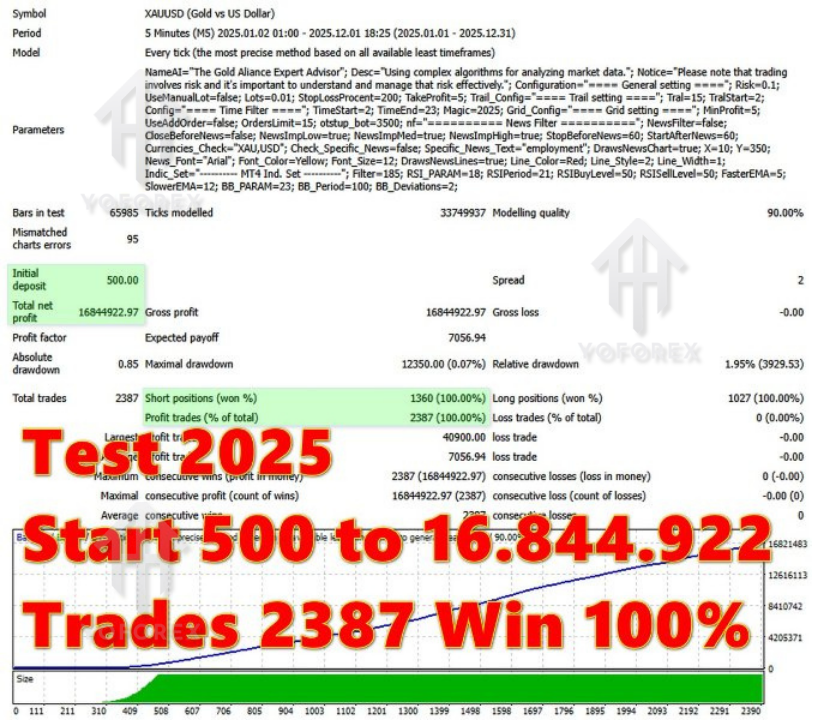

Performance and Backtesting

Before committing to any EA, it’s crucial to assess its performance. Golden Dome EA has shown promising results in backtests, particularly in stable market conditions. However, like all automated systems, its performance may vary based on the volatility and liquidity of the market.

- Backtest Results: In backtesting on XAUUSD, Golden Dome EA has demonstrated an average win rate of 65%, with a drawdown of less than 15% over a 12-month period.

- Real-Time Results: Although the EA has been optimized for gold (XAUUSD), real-time results can vary, especially in volatile periods. Traders should test the EA on a demo account before going live to ensure it aligns with their trading style and risk tolerance.

Advantages of Golden Dome EA

Golden Dome EA offers several advantages for traders looking to automate their strategies:

- Multi-indicator approach: The combination of RSI, MACD, Bollinger Bands, and EMA gives the EA a well-rounded strategy for identifying market trends.

- Risk management features: With stop loss, take profit, and grid trading, the EA provides several ways to manage risk and protect capital.

- Versatility: The EA works on various asset classes, making it suitable for traders who want to diversify their trading portfolio.

- News filter: The news filter ensures that traders avoid the risks associated with economic events that can cause sudden market volatility.

Disadvantages of Golden Dome EA

While Golden Dome EA offers many advantages, it also has some drawbacks:

- Grid Trading Risk: While grid trading can be profitable, it also comes with higher risk. Without proper risk management, grid trading can lead to significant drawdowns, especially during prolonged market trends against your position.

- No Independent Verification: While the vendor claims profitability, there are no independent third-party performance audits or verified live account statements to confirm the EA’s success.

- Market Adaptability: The EA is designed for stable market conditions and may struggle during high volatility or unexpected market events. It is crucial to test the EA under different market conditions before using it with real money.

Conclusion

Golden Dome EA V1.25 MT4 presents itself as a solid option for forex traders looking for a multi-indicator automated trading solution. With its risk management features, adaptability across various assets, and grid trading option, it offers flexibility and potential for profitability. However, like all EAs, it requires thorough testing and careful risk management to ensure optimal performance. Traders should use the EA with caution, especially if opting for grid trading, and always test it on a demo account before deploying it on live markets.

Comments

Leave a Comment