Introduction: The Market Isn’t Confusing—It’s Just Selective

The forex market has never been chaotic. It has simply been selective about who gets paid. While retail traders argue with indicators and redraw trendlines for emotional comfort, institutions quietly move price toward liquidity, collect orders, and leave behind confusion as a courtesy.

Liquidity Engine SMC ICT EA V1.15 MT4 exists for traders who are tired of pretending randomness is strategy. Built on Smart Money Concepts (SMC) and ICT methodology, this Expert Advisor does not chase candles or react late. It waits patiently for liquidity to be taken, structure to shift, and price to behave the way it was always intended to.

No guessing.

No chasing.

No emotional bargaining with the chart.

What Liquidity Engine SMC ICT EA V1.15 MT4 Actually Does

Liquidity Engine SMC ICT EA V1.15 MT4 is an automated trading system for MetaTrader 4 designed to execute trades based on institutional price behavior. Instead of responding to indicators after the move, it focuses on liquidity inducements, market structure, and high-probability execution zones.

This EA is not interested in predicting the market. It assumes the market already knows where it’s going—and simply waits for confirmation before stepping in.

Think of it less as a “robot” and more as a disciplined assistant who refuses to trade unless conditions make sense.

The Smart Money Logic Behind the EA

Institutions don’t enter randomly. They engineer price movement to fill orders efficiently. Liquidity Engine SMC ICT EA V1.15 MT4 is built on that uncomfortable truth.

The EA monitors price action to identify:

Liquidity sweeps above highs and below lows

Market structure breaks that signal intent

Premium and discount zones aligned with ICT logic

Controlled entries after inducement

Only when these elements align does the EA execute a trade. This is not impatience-friendly software. It is probability-focused automation.

How Liquidity Engine SMC ICT EA V1.15 MT4 Works in Real Conditions

The EA continuously scans selected currency pairs for institutional footprints. When liquidity is taken and structure confirms a directional shift, trades are placed with predefined stop loss and take profit levels.

Risk management is automated. Trade frequency is intentionally limited. Overexposure is avoided.

It does not care how exciting the market looks.

It cares whether the setup is valid.

Which is precisely why most retail traders would ignore it manually—and exactly why automation helps.

Key Features of Liquidity Engine SMC ICT EA V1.15 MT4

Liquidity-Driven Trade Entries

Trades are executed near liquidity zones where smart money activity is most likely.

SMC and ICT Methodology

Applies institutional concepts rather than lagging indicators.

Built-In Risk Control

Stop loss and take profit logic is applied systematically to protect capital.

Market Structure Awareness

Avoids counter-trend entries unless structure confirms reversal.

Emotionless Execution

Never panics, hesitates, or revenge trades. A rare quality.

Performance Behavior and Trade Style

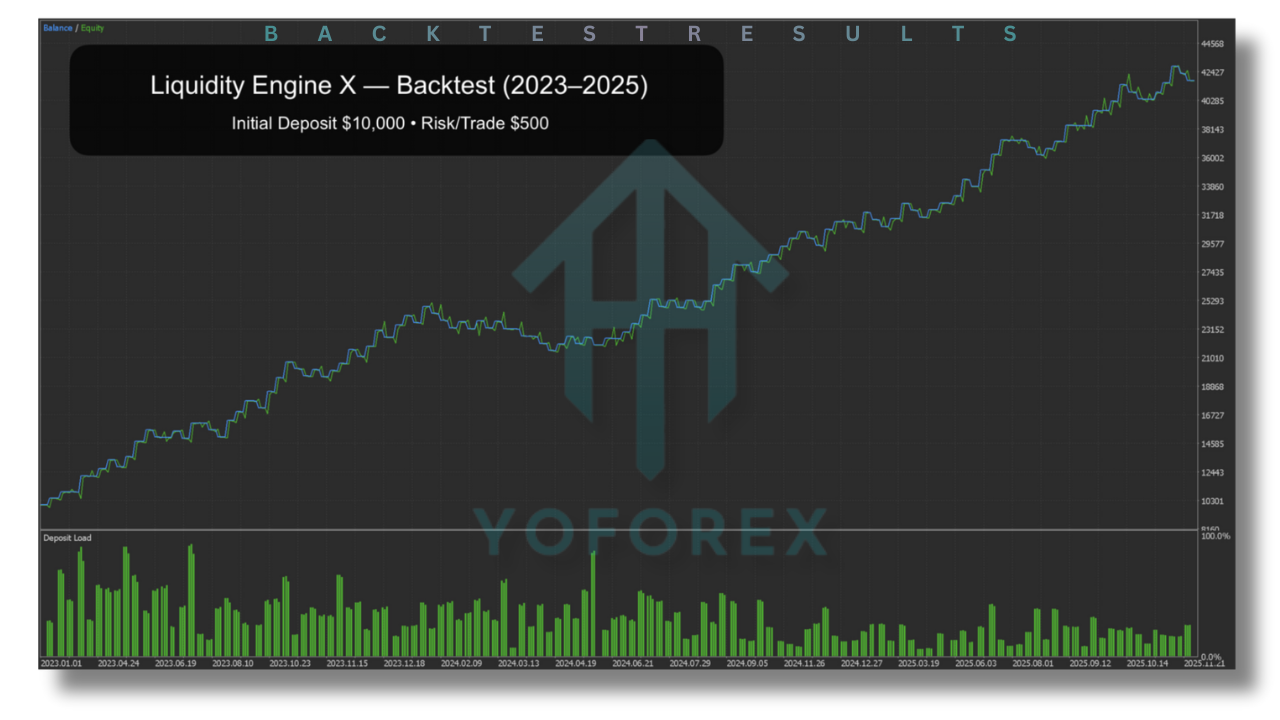

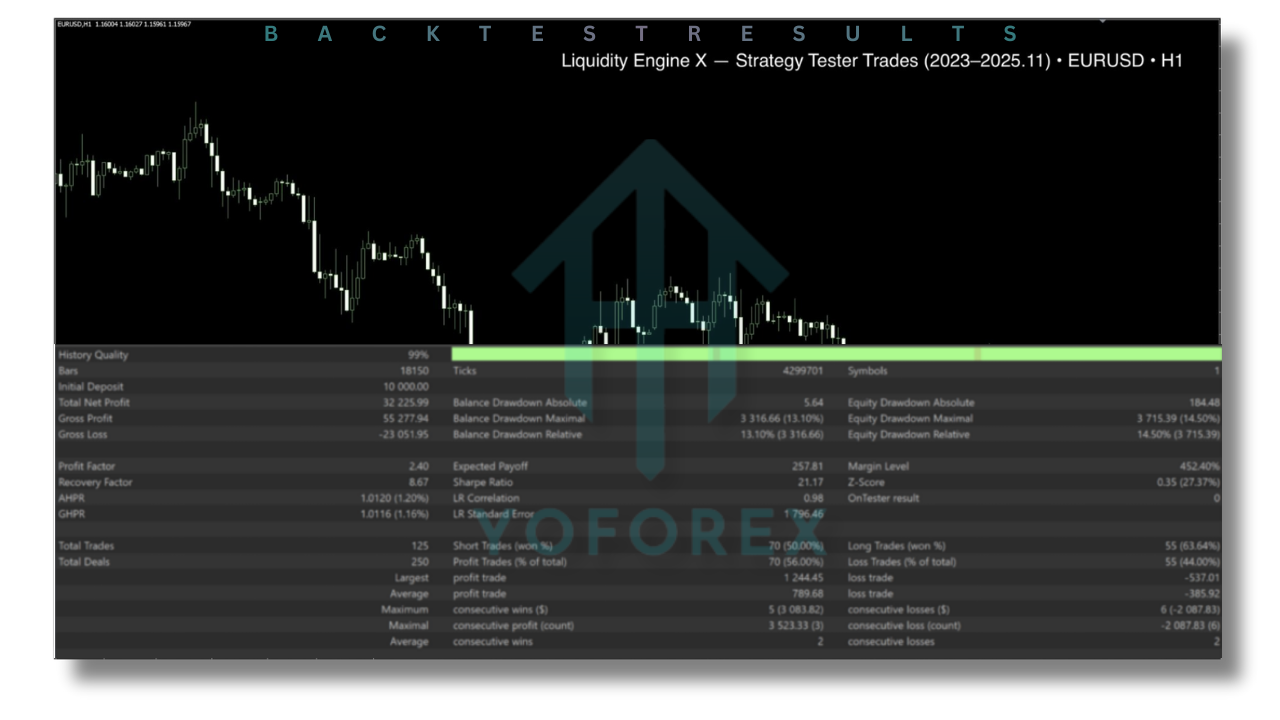

Liquidity Engine SMC ICT EA V1.15 MT4 is designed for controlled exposure, not constant action. Trades are fewer but higher quality, focusing on favorable risk-to-reward conditions.

Drawdowns are managed by strict entry filtering. Profits are expected to grow steadily, not explosively.

This EA is not designed to impress impatient traders.

It is designed to survive long enough to matter.

Who This EA Is Actually For

Liquidity Engine SMC ICT EA V1.15 MT4 is suitable for traders who:

Understand or respect Smart Money and ICT principles

Prefer logic over excitement

Want automation without abandoning discipline

Value consistency more than hype

It is not suitable for traders who believe every candle is an opportunity.

Advantages and Practical Limitations

Advantages

Institutional-style logic

Reduced emotional interference

Structured and repeatable execution

Adaptable to varying market conditions

Limitations

Not a high-frequency EA

Requires patience and realistic expectations

Performance depends on broker quality and spreads

In short, it behaves like a professional—not a lottery ticket.

Why Liquidity Engine SMC ICT EA V1.15 MT4 Is Different

Most EAs react.

This one waits.

Liquidity Engine SMC ICT EA V1.15 MT4 focuses on why price moves, not just where it ended up. It avoids the illusion of control created by excessive indicators and instead trades around institutional intent.

It does not promise certainty.

It offers structure.

And structure is what most traders lack.

Final Verdict: Smart Money Without the Guesswork

Liquidity Engine SMC ICT EA V1.15 MT4 is a disciplined, logic-driven trading system designed for traders who are done blaming the market and ready to follow it properly.

It does not trade every day.

It does not chase moves.

It does not entertain.

It executes with intent.

If your goal is consistency rather than excitement, this EA fits the role quietly—and effectively.

- Whatsapp Support: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment